Chinese financial markets are rediscovering an appetite for risk not seen in months, taking cues from the government’s biggest push yet to invigorate this year’s slowing economy.

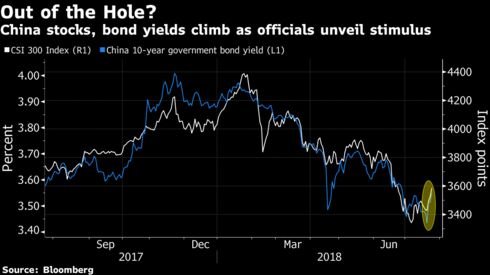

The CSI 300 Index of mainland stocks climbed 1.6 percent Tuesday, capping its biggest three-day gain since mid-August 2016, when economic indicators vindicated China’s moves to stabilize a slowdown back then. While there’s no guarantee of success this time, with the X-factor of a trade dispute with the U.S. at play, traders are betting big.

The rally looked to continue Wednesday, with futures on the FTSE China A50 rising 0.6 percent. The offshore yuan is holding near the weakest in more than a year against the dollar after Monday’s record injection of funding to lenders by the People’s Bank of China. Benchmark 10-year government bond yields have risen from the lowest since April 2017.

The moves could portend an end to the bearish sentiment that’s clouded China’s markets for months. Investors have been fleeing equities and taking shelter in bonds, spooked by a deleveraging campaign that’s contributed to a record run of corporate defaults and a slide in public investment. Prospects for U.S. tariff hikes on an increasing swathe of Chinese exports haven’t helped. It all added up to a $2 trillion equity wipeout from January highs.

Read more at Bloomberg.