-

Thailand, Indonesia, Malaysia to increase exports from April

-

Market speculates Chinese tires may be caught in any trade war

There’s no respite for rubber prices weighed down by too much supply as key producers prepare to boost shipments from this month.

An agreement by Thailand, Indonesia and Malaysia in late December to reduce exports by 350,000 metric tons expired on March 31. That’s spurred concerns that more supply from the countries, that together account for about 70 percent of global production, will hit the market just as demand is weakening and trade tensions between the U.S. and China heat up.

“The market lacks bullish factors and the export resumption pressures prices,” said Kazunori Kokubo, managing director at Yutaka Shoji Singapore Pte. Trade tension between China and the U.S. is causing uncertainty across markets and is negative for rubber prices, he said.

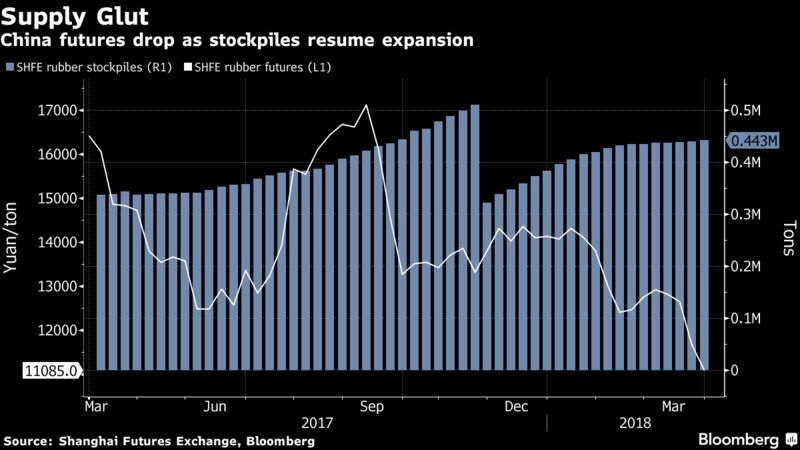

Rubber futures in Tokyo, Shanghai and Singapore have dropped more than 20 percent over the past year on an uncertain outlook for consumption. World natural rubber production rose 4.3 percent in the first two months of 2018, outpacing the 0.8 percent increase in demand, according to the Association of Natural Rubber Producing Countries. Retail auto sales in China, the world’s top rubber consumer, fell 2.4 percent in February and rubber inventories monitored by the Shanghai Futures Exchange have expanded for 18 straight weeks.

“Due to strict environmental requirements, tire makers are running at low capacity, which will hurt rubber demand,” said Shi Hai, a senior researcher with Industrial Futures Co. Growth in China’s infrastructure investment and vehicle production has also slowed, he said.

Price Drop

TSR20 futures in Singapore could drop to as low as $1 per kilogram in the next three to six months, from $1.37 on Tuesday, due to excessive supplies, Shi forecast. Rubber futures on the Tokyo Commodity Exchange could drop to as low as 140 yen ($1.32) with any rally limited to 200 yen, he predicted. The most-active contract closed at 180.4 yen on Tuesday.

The rubber market is also assessing the possibility that Chinese tiremakers may get caught in any retaliatory trade tariffs between the U.S. and China. The U.S. announced a proposed list of tariffs on Chinese-made products that includes new and retreaded pneumatic and non-radial rubbers tires used on aircraft. The Asian nation on Monday put into effect previously announced measures on $3 billion worth of imports of American goods including pork and wine.

“The U.S. previously imposed tariffs on tire imports from China when shipments surged,” said Takaki Shigemoto, an analyst at JSC Corp., who predicts futures in Tokyo will trade in a 140 yen to 190 yen range for the next three months. “If the U.S slaps tariffs on Chinese tires this time too, that would be negative.”

Still, the slump in prices could set the stage for a future rally. Current low prices have discouraged farmers and workers from tapping, raising concerns about a rubber sheet shortage, said Bundit Kerdvongbundit, vice president of Von Bundit Co., one of the top natural rubber manufacturers and exporters in Thailand.

Thailand is also seeking to buoy prices by raising local consumption. Shipments from the world’s biggest exporter may decline 6 percent this year due to increasing domestic demand, according to the Rubber Authority of Thailand. Production may rise 8.4 percent to 4.8 million tons.

“We need to assess the market after the export resumption for whether we would see an influx of supply,” said Korakod Kittipol, marketing manager at Thai Hua Rubber. The surplus could see Tokyo futures drop to 160 yen a kilogram and TSR20 prices decline to $1.20 a kilogram, he said.

— With assistance by Aya Takada, and Shuping Niu

Source: Bloomberg